Our experts frequently write blog posts about the findings of the research we are conducting.

SEC Awards More Than $14 Million to Whistleblower

FINRA Files Cease and Desist RE: John Carris Investments and Fibrocell Science

SEC Proposes Rule for "Pay Ratio" Disclosure

SEC Approves Municipal Adviser Registration Requirement

SEC Cracks Down on Firms for Short Selling Violations

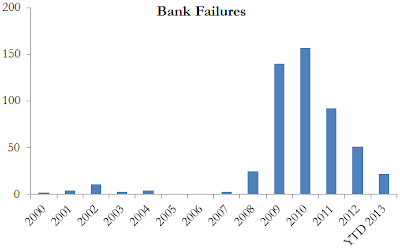

FDIC Goes After Directors of Failed Banks

FINRA Study: Financial Scams Prevalent

SEC Halts Florida-Based Prime Bank Investment Scheme

CFTC: Concept Release on Risk Controls and System Safeguards for Automated Trading

Illiquid ETFs and SEC Market Maker Incentives